- Electronic deposits that are automatically initiated outside the bank - like Direct Deposit or Social Security benefits - are generally available immediately. Cash deposited via one of our deposit taking ATMs and transfers between Capital One 360 and Capital One Bank accounts are also available immediately.

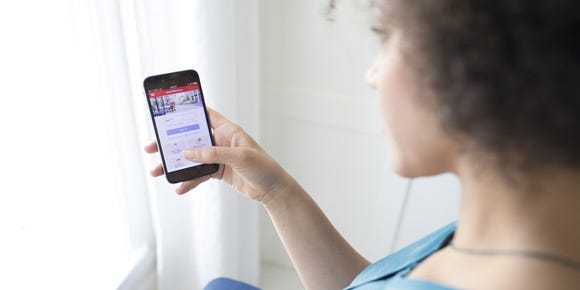

- Go to the Capital One Mobile app and select your account. Click on “Deposit” next to the camera icon. Take photos of the front and back of your check (please write 'for Capital One mobile deposit' and sign your name on the back of the check prior to taking your picture).

Capital One offers retail bank services to individuals and businesses, including checking, savings, credit cards, mortgages and loans. Clients can review their account balances and transactions through online banking and mobile banking apps for iPhone, iPad, and Android devices.

1. External AccountYou can link your checking or savings account to an account you have at another bank. Doing so lets you easily transfer funds between your accounts.Learn how to link an external account online.

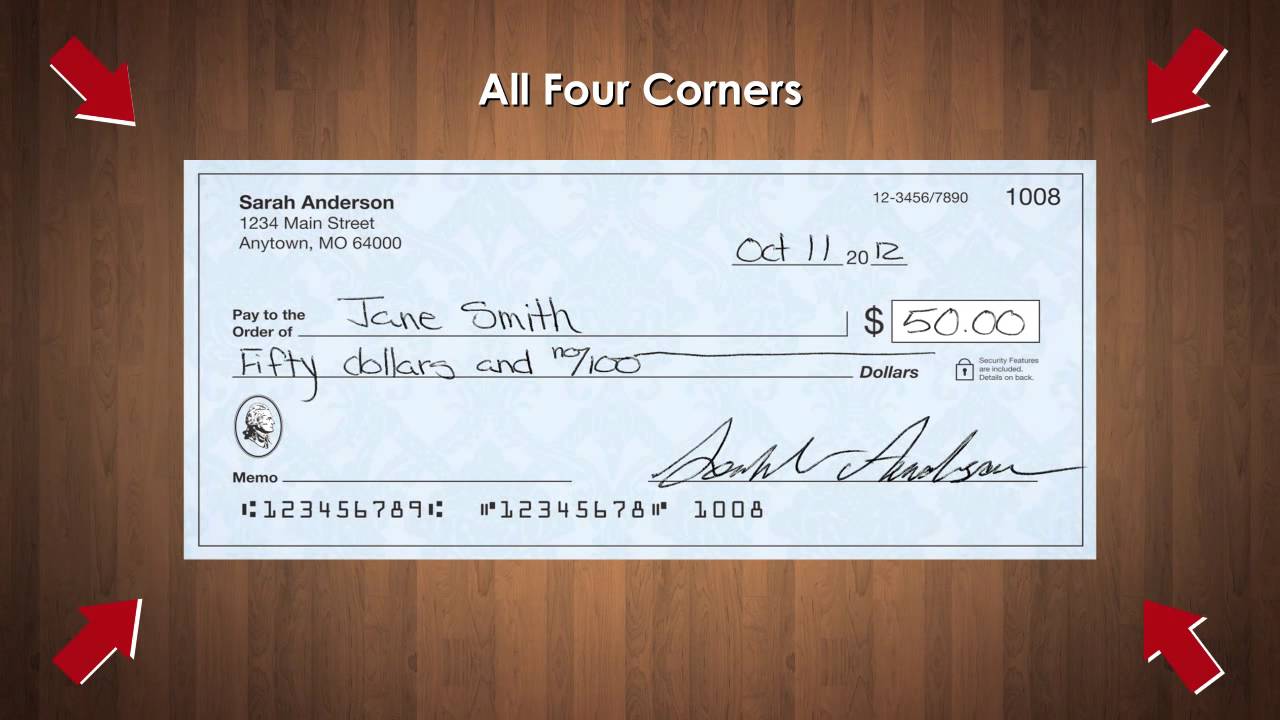

2. Mobile DepositDeposit a check from anywhere in the U.S. and U.S. territories with Mobile Deposit. Follow these steps on our mobile app to snap a picture of your check:

- Go to the Capital One Mobile app and select your account.

- Click on “Deposit” next to the camera icon.

- Take photos of the front and back of your check (please write "for Capital One mobile deposit" and sign your name on the back of the check prior to taking your picture).

- Follow the prompts to fill out the deposit amount and, if you’d like, a memo.

- Slide your finger across the green button to complete your deposit.

3. ATM DepositIf you live near a Capital One Café or Capital One Bank location, you can make a check deposit at the ATM at that location. Find out if there’s one near you.

4. Direct DepositYou can set up Direct Deposit by giving your Capital One account number and routing number to your employer. You can find that information either:

- In the app: Sign in and select your bank account. Scroll down to “Account Info” and select “Show More.”

- Online: Sign in and select your bank account. Click on “View Details” underneath the name of your account in the top left corner

You can also set up Direct Deposit by printing out our blank Direct Deposit form, filling in your information and giving it to your employer.

5. Make a transferVisit our Transfers page to learn more about making a transfer.

For more information about how long it takes for money to move in and out of your account, please visit the Funds Availability Page.

'>1. External AccountYou can link your checking or savings account to an account you have at another bank. Doing so lets you easily transfer funds between your accounts.

Learn how to link an external account online.

2. Mobile DepositDeposit a check from anywhere in the U.S. and U.S. territories with Mobile Deposit. Follow these steps on our mobile app to snap a picture of your check:

- Go to the Capital One Mobile app and select your account.

- Click on “Deposit” next to the camera icon.

- Take photos of the front and back of your check (please write 'for Capital One mobile deposit' and sign your name on the back of the check prior to taking your picture).

- Follow the prompts to fill out the deposit amount and, if you’d like, a memo.

- Slide your finger across the green button to complete your deposit.

3. ATM DepositIf you live near a Capital One Café or Capital One Bank location, you can make a check deposit at the ATM at that location. Find out if there’s one near you.

4. Direct DepositYou can set up Direct Deposit by giving your Capital One account number and routing number to your employer. You can find that information either:

- In the app: Sign in and select your bank account. Scroll down to “Account Info” and select “Show More.”

- Online: Sign in and select your bank account. Click on “View Details” underneath the name of your account in the top left corner

You can also set up Direct Deposit by printing out our blank Direct Deposit form, filling in your information and giving it to your employer.

5. Make a transferVisit our Transfers page to learn more about making a transfer.

For more information about how long it takes for money to move in and out of your account, please visit the Funds Availability Page.

Mobile RDCMobile Deposit is only available in the U.S. and U.S. territories. Web access is needed to use Mobile Banking. Check with your service provider for details on specific fees and charges.

See the Mobile Deposit Terms and Conditions for complete details.

Android is a trademark of Google Inc. Apple, iPhone and iPad are trademarks of Apple Inc., registered in the U.S. and other countries.

ProDepositSM

If you make a deposit using ProDeposit before 11 p.m. ET, we will consider the deposit to be made that business day. However, if you make a deposit after 11 p.m., or on a day we are not open, we will consider the deposit to be made on the next open business day. The ProDeposit service is available to enrolled Spark Business Unlimited Checking customers or Spark Business Basic Checking customers only. To be eligible, you cannot be enrolled in any other Capital One Cash Flow Management services. Service is subject to client eligibility qualification and approval. ProDeposit requires a monthly service fee of $50. Service is valid for one business (TIN) and one checking account with access for up to 5 users. If the ProDeposit service is canceled within 12 months of enrollment, the scanner must be returned in proper working condition within 30 days of the cancellation request. If the scanner is not returned and/or is not in proper working order, a $250 scanner replacement fee will apply. Upon approval, you will receive one single-feed remote deposit capture scanner at no cost to you. Use is restricted to a maximum of $250,000 in checks deposited over a rolling 20 business days. Capital One reserves the right to lower this check deposit limit at any point based on risk or usage patterns. Replacement scanners are subject to a charge. Please talk to your banker for full terms and conditions. Terms and conditions are subject to change without notice.

ATMATM functionality and appearance can vary by region.

Online Banking

Capital One Mobile Deposit Unavailable

Online Bill Pay is not intended for use by commercial and institutional clients with annual sales exceeding $20 million.

Capital One Mobile Deposit Image

Products and services offered by Capital One, N.A., Member FDIC © 2017 Capital One. All rights reserved.